Plex: 07 January 2026

The Startup as Parasite (Kevin Jones); The Story That Owns Us (Jose Leal)

The Biweekly Plex Dispatch is an inter-community newspaper published on the first and third Wednesdays of each month.

In This Issue

- The Startup as Parasite (Kevin Jones)

- The Story That Owns Us (Jose Leal)

The Startup is a Parasite

by Kevin Jones

There are wasps that sting an ant and deposit their eggs in their brains. When they hatch, they turn the ants into beings with no will of their own, dedicated to the service of the parasitical species that has taken over their brains.

After succeeding nine out of ten times in startups over 50 years, I think that analogy fits life as the lead visionary entrepreneur in a startup. You serve the startup; it is your master, if you want to succeed. And every startup has a tiny window to fly through in order to succeed. Your time is bounded by the need to achieve first the ability to pay the people who will help you, and then to make your founding team economically viable and eventually dominant in its market niche.

My wife and business partner Rosa Lee and I have done this successfully nine times, from the poorest county in the poorest state in the country to a global scale, with conferences in Singapore, London, Amsterdam, Sweden, New York and San Francisco, with other stops along the way.

Sometimes the opportunity was, as it was in Itawamba County, Mississippi, to create a community in an impoverished place that would enable your information business to survive. Sometimes it was to define a market at a time when Wall Street and the world thought it was an important thing to do, and to exit before the bubble burst with the most cash, least stock and shortest earnout, while people still thought things would go up forever.

The last two startups came after my daughter asked me a life-changing question. After our dot-com success, I haven't had to take a paycheck for the last 25 years, but as I do, I was wandering like a truffle hound toward the next startup. She said, "Dad, you've proved you can do business beyond Mississippi and you don't need the money, so what are you doing? What's your life about?" After a year or so of wandering after we cashed out—discovering I really didn't want to make furniture, taking big vacations around the world—I decided to answer that question.

I discovered I was not a fit for a nonprofit board, with its incremental change and consensus approach. Two years working to solve malaria in Mozambique and Swaziland with a couple of retreaters along convinced me I was not suited to work directly on changing the world. But our last business had been conferences timed to take advantage of new things emerging at historic market inflection points. So we did that twice, trying to gather people to think and act differently about the way they acted with their investments, and act their way into a new way of thinking. The first one worked for a while, then the market took over the meaning. Impact investing did not change the way people acted with their money the way I hoped it would, but it did some substantial good.

With impact investing being taken over by a focus on doing good at market rate, we sold and created a business focused on gathering the people repairing local economies. It's a for-profit, as all of our initiatives have been, but because it requires the whole community to be engaged to make change, it's a long-term initiative. We can do another one this coming fall and prep the business for sale to a nonprofit buyer who will keep the mission intact.

That's the business history side of the story. People are increasingly realizing that the economy can be repaired if you build the means of exchange and the rules around ownership, land and the rights of the most fragile part of your community are protected. We can survive the impact of climate change better if we coordinate locally, focusing on the neighborhoods most impacted by climate—the poor folks down where it floods—because as the Helene hurricane disaster made us realize in Swannanoa, we are all in it together.

But my role as entrepreneur is what I am struggling to examine here. I served the startup. My success is fairly remarkable, starting out as poor as my family was, to where we are now. The startup culture of Silicon Valley and San Francisco and the struggling movement of social enterprise, business with a social purpose, was my deepest home. But the startup took over, and I served it.

As I look back now, it was riding me. I was not riding it. It took more from me than I realized at the time. I liked the tradeoff of being seen as influential and a winner. This is not just a plea to wake up to wellness. It's that business for good is still at its essence based on consuming the entrepreneur.

Now that I am past that stage, I have time to do the daily things of life: cleaning out a rental property, helping with Christmas preparations for the holidays. And working on our book, This Shit Works, and Why it Matters. Rosa Lee will handle most of the why. The live interviews on Substack are coming. We are going to write most of it through Substack and our Neighborhood Economics newsletter. There are locally applicable solutions that create economic power in the neighborhoods where people die ten years younger in every city.

I realize I have only touched on the consumptive aspect of the startup. This is the first time to work on that thought. More to come.

The Story That Owns Us

When Money Became Real

by Jose Leal

First published in the Radical🌍World Blog: The Story That Owns Us

(Serving Life Series – Part Two Finale)

I was born on a small island called Pico, in the middle of the Atlantic.

We lived in a tiny house with no running water, on land leased for 99 years from an actual “land lord.” From the beginning, I understood that even the ground beneath our feet could belong to someone else.

Money wasn’t something we had, and it wasn’t something I thought much about. It was simply there, deciding what was possible, shaping what could be dreamed. Still, I didn’t chase it.

Years later, when I became a vice president in the corporate world, that illusion began to dissolve. Between the sale of my business and my salary and bonus, I earned more than I had ever imagined, enough to erase all practical worries. Yet the more I made, the more I felt how deeply money had replaced life as our measure of meaning.

The numbers made sense, but nothing else did.

Most of my conversations had turned into calculations. Relationships became transactions. Meetings revolved around numbers: budgets, forecasts, targets — as if life itself could be balanced like a ledger. The turning point for me was when I found myself ‘laying off’ committed people who had been working hard because of decisions made by those who held the purse strings.

That was the moment I realized how thoroughly our lives were organized by money — how easily human care can be overruled by calculation.

When the Symbol Outranks Life

In 2013, the city of Detroit began shutting off water to thousands of homes. Mothers filled buckets from fire hydrants. Children carried bottles to school. The city owed billions to bondholders; residents owed hundreds in unpaid bills. Under pressure from Wall Street, the water department made its choice: cut water to the people, not the investors.

The pipes still carried water. The rivers still flowed.

But the story had changed. It wasn’t about thirst or health anymore. It was about debt.

That’s what happens when a symbol begins to outrank life itself.

We say things like, “If they don’t pay, they should face the consequences.”

That reaction makes perfect sense inside the money story: a world where debts are moral facts and punishment is the balancing entry. But notice how easily our sympathy bends toward the account book. The story of tokens runs deep; it teaches us to measure worth by what can be priced rather than by the needs that make life possible.

From Shared Need to Quantified Control

After land was fenced and time was sold, money rose as the universal token — the symbol that could stand for anything: water, labor, care, even trust.

At first, it may have been a convenience, a way to ease exchange. But over time, the symbol began to feel more real than the life it represented. When people say, “We can’t do it, there’s no budget.” They’re not describing physical limits; they’re describing the boundaries of a story.

Budgets are beliefs about what deserves to live.

Through the Story Lens, money feels natural, even moral: it keeps things organized, measurable, efficient. Through the Life Lens, it’s a fiction that has escaped its frame — a stand-in for energy that now decides where energy may flow.

Money didn’t just represent life — it began to replace it.

We built this world on a root story of Necessary Control — the belief that exchange must be centralized and regulated to prevent chaos. It’s reinforced by the myth of Human Flaw — that we can’t trust generosity or reciprocity, so trust must be priced. And it expresses itself through Rational Supremacy — the conviction that numbers are more “real” than needs, relationships, or ecosystems.

When Tokens Replace Trust

A farmer burns crops to keep prices stable.

A hospital refuses care until credit clears.

Governments subsidize fossil fuels while declaring there’s “no money” for clean water.

The absurdity isn’t economic — it’s existential.

Life doesn’t run on balance sheets; it runs on flows. Energy moves. Water circulates. Nutrients return to the soil. Money, in its early form, mirrored that rhythm. Now it also stops it. We hoard the symbol and starve the source.

The world overflows with food, yet millions go hungry — not for lack of supply, but for lack of currency. Forests fall so digits can rise. We’ve mistaken the measure for the meaning.

When tokens replace trust, control replaces connection — and that control soon demands its own machinery.

Reclaiming the Real

Through the Life Lens, money is neither good nor evil. It’s a story — one that worked until it didn’t. It represents energy, but it is not energy.

The Life Lens begins when our stories stay bound to the realities of life itself. It asks that our symbols — money, property, contracts, even progress — remain in service to the living flows they describe. Through this lens, the test of any story isn’t how logical or efficient it sounds but whether it keeps life moving, whether it nourishes, regenerates, and connects.

When we treat money as life, we forget how to exchange life directly — through trust built on relationship and belonging, reciprocity, and shared stewardship. When we remember that money is a tool, not a truth, we can rewrite the story.

But the story can change — because we can.

Communities already are.

Local currencies circulate care.

Mutual-aid networks share without accounts.

Collaboratives exchange contribution instead of profit.

The shift isn’t from money to something else — it’s from control to connection. From counting life to serving it.

Returning Life to the Center

I think back to that little house, to the sense that what was essential was somehow owned by someone else. It’s a story that has been told so well that we’ve come to live through it.

But beneath every dollar, every contract, every fight for market share, there is something more fundamental: the pulse of life itself — giving, receiving, adapting, becoming.

That is the real economy — a living economy.

Because every story unbound from life seeks to control it — and every story rooted in life learns to serve it.

And that is where this journey turns next. Toward how we might remember that flow and restore balance, not by rejecting our tools, but by returning them to their rightful place: in service to life.

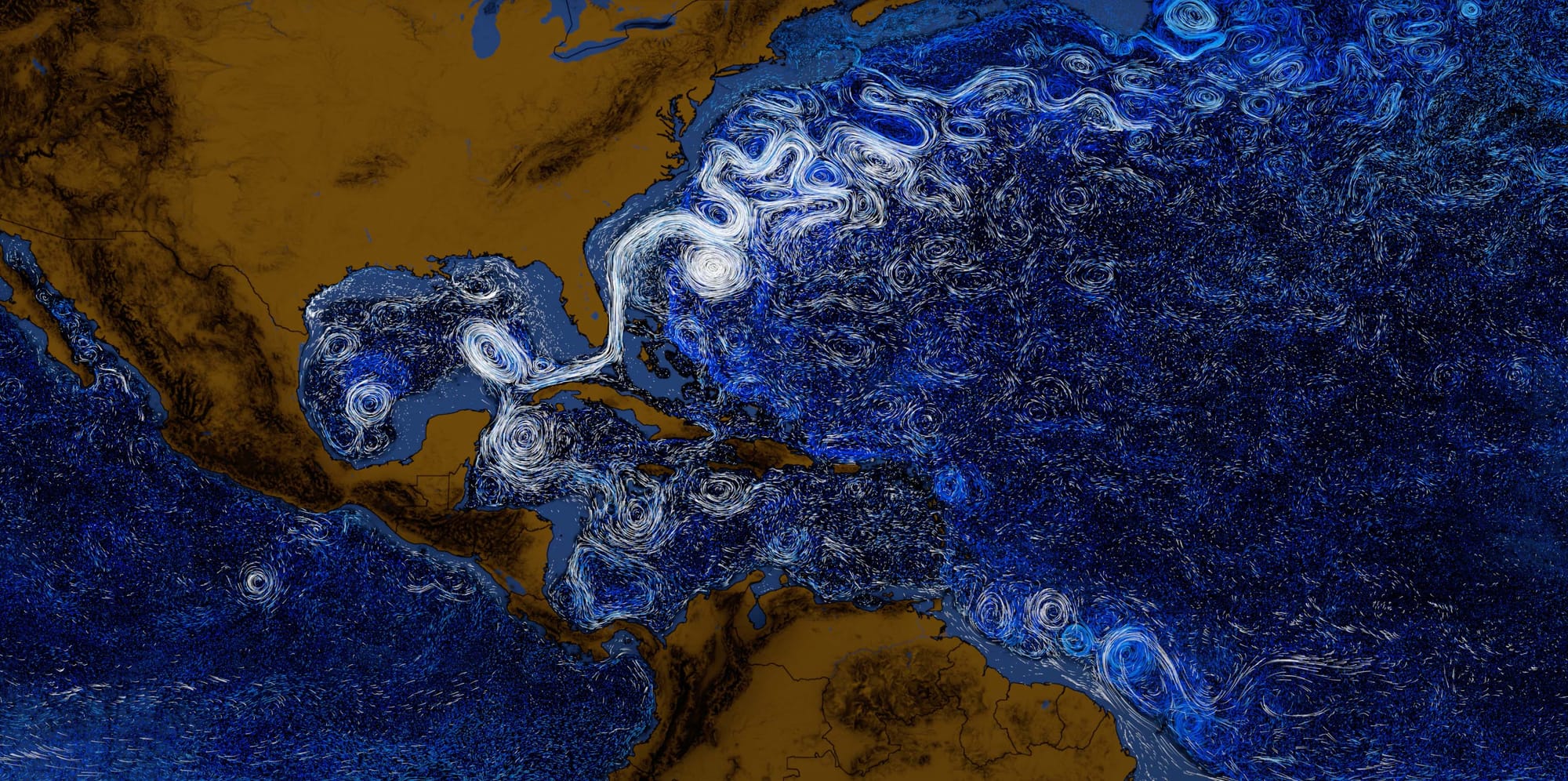

Here's the source for the full animation.

Thank you for reading! The next issue will be published on 21 January 2026.

Grateful appreciation and many thanks to Kevin and Jose for their kind contributions to this issue.

The Plex Dispatch team welcomes contributions. Email Kevin with suggested submissions.

Kevin Jones works at the intersection of faith and economic justice with people repairing local economies. Email Kevin.

John Warinner helps people design and sustain systems that enable all members to flourish together. Email John.